Introduction

Most entrepreneurs face a frustrating paradox when seeking business financing. Banks want to see two years of operating history before approving loans, but you need capital now to grow your business. Recent Federal Reserve data shows that 43% of small businesses can’t access adequate financing, with lack of credit history being the top rejection reason.

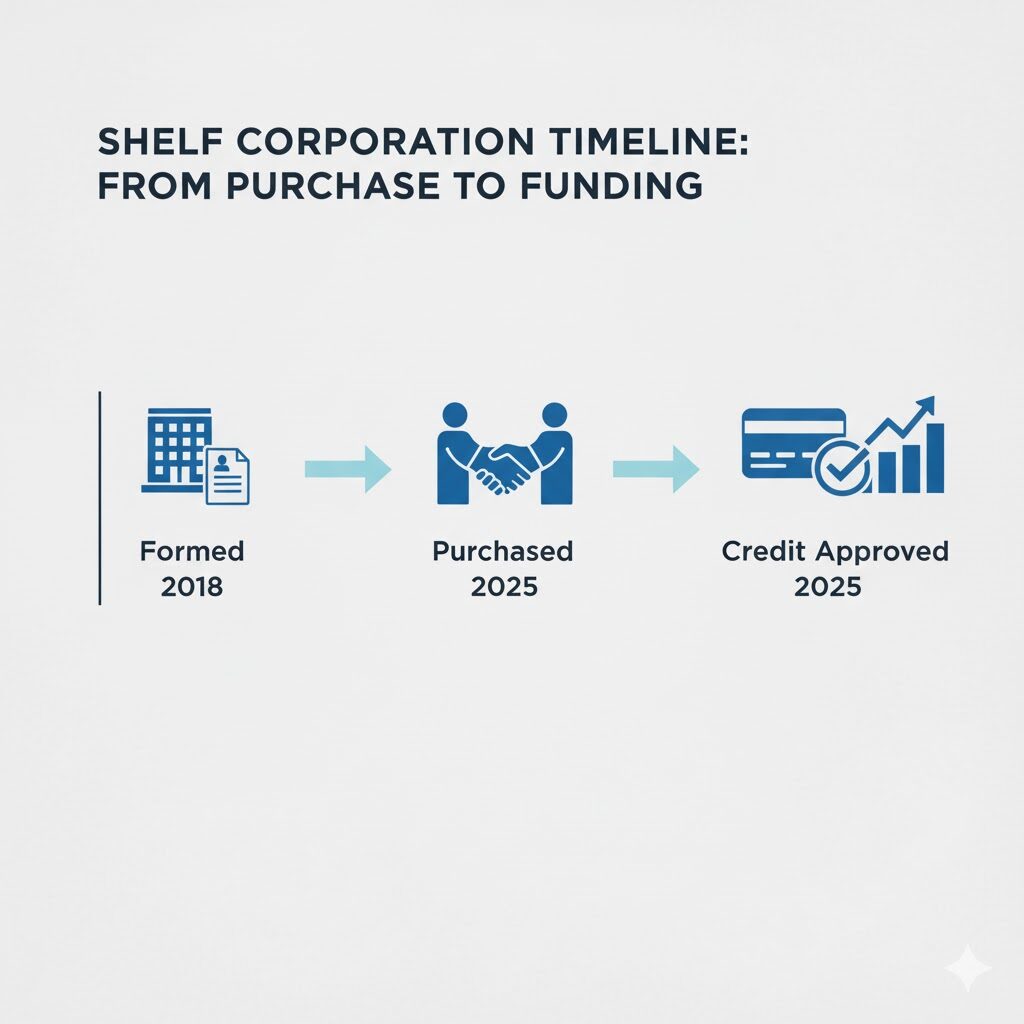

Shelf corporation funding solves this timing problem by giving you instant business age. When you acquire an aged entity, you bypass the typical waiting period that prevents new businesses from qualifying for credit. Lenders view corporations formed years ago as more stable and creditworthy than startups registered last month.

Wholesale Shelf Corporations helps entrepreneurs access capital faster through properly aged business entities. These pre-formed corporations come with established formation dates that meet lender requirements for time-in-business credentials. Understanding how to leverage these entities for funding can accelerate your growth trajectory significantly.

This guide explains exactly how shelf corporation funding works, from initial purchase through credit building and loan approval. You’ll learn proven strategies for establishing business credit quickly, common mistakes that delay funding approval, and realistic timelines for accessing different types of financing.

What Is Shelf Corporation Funding?

Shelf corporation funding refers to obtaining business credit, loans, or vendor financing using an aged corporation as your business entity. The corporation’s established formation date helps you meet lender requirements faster than starting with a newly formed company. This approach leverages time-in-business credentials you acquire rather than build organically.

The process combines two separate transactions. First, you purchase a shelf corporation with credit potential or an existing credit profile. Second, you use that aged entity to apply for business financing that would typically reject brand-new companies. The corporation’s history serves as your qualification foundation.

Real-world example: A contractor purchases a five-year-old corporation in March and establishes vendor accounts immediately. By June, she qualifies for a $25,000 business credit card that her three-month-old LLC couldn’t access. The aged corporation compressed years of credit building into months.

Why Shelf Corporation Funding Matters

Access to working capital determines whether businesses can seize growth opportunities or watch them pass by. Traditional business credit building requires 12 to 24 months of documented payment history before qualifying for substantial credit lines. Shelf corporation funding reduces this timeline to three to six months when executed properly. Click here to see Benefits of Shelf Corporation.

Contract opportunities often require proof of financial stability. Many government agencies and large corporations mandate that vendors carry specific insurance coverage, bonding capacity, or credit lines before awarding contracts. A shelf corporation with credit helps you meet these requirements years faster than organic growth allows.

Cash flow management becomes easier when you can access business credit cards, vendor net-30 terms, and equipment financing. These tools let you purchase inventory, cover payroll gaps, and invest in marketing without depleting cash reserves. The aged corporation creates qualification pathways that preserve your working capital for strategic investments.

How Shelf Corporation Funding Works

The funding process begins with acquiring a properly aged corporation that meets your business needs. Quality providers like wholesaleshelfcorporation offer entities aged two to ten years, with clean compliance records and verified formation dates. You want corporations with no prior business activity, liens, or negative credit history.

Activation steps determine your funding success. You must open business bank accounts, obtain an Employer Identification Number if needed, and register with commercial credit bureaus. File beneficial ownership reports, update registered agent information, and ensure all state compliance documents remain current. These actions prove your corporation operates legitimately.

Building initial credit starts with vendor accounts that report to business credit bureaus. Office supply companies, gas card providers, and telecommunications vendors offer net-30 terms to new accounts. Making on-time payments for three to six months establishes positive trade lines that appear on your Dun & Bradstreet and Experian Business reports. How to Buy Shelf Corporation?

Types of Financing Available

Business credit cards represent the fastest path to revolving credit. Many issuers approve aged corporations for secured cards within weeks of application. After demonstrating responsible usage for three to six months, you can qualify for unsecured cards with limits ranging from $5,000 to $50,000 depending on your credit profile.

Equipment financing and vehicle loans become accessible once you establish basic trade lines. Lenders specializing in asset-based financing care more about the collateral value than extensive operating history. Your shelf corporation with credit provides the legitimacy needed, while the equipment itself secures the loan.

Term loans and lines of credit require stronger business credit profiles. Most banks want to see 12 months of positive payment history and revenue documentation before approving unsecured term loans. However, aged corporations meet the time-in-business threshold immediately, cutting the qualification timeline substantially compared to new entities.

Best Practices for Fast Funding

Start with tier-one vendor accounts that report to all major business credit bureaus. Companies like Quill, Grainger, and Uline approve most applications and report payment activity monthly. Establish five to ten vendor accounts within your first month of operation to build credit file density quickly.

Maintain perfect payment timing across all accounts. Business credit scoring weighs payment history more heavily than consumer credit models. Even one late payment can delay your progression to higher credit tiers. Set up automatic payments or calendar reminders to ensure you never miss due dates.

Separate business and personal finances completely. Open dedicated business checking accounts, use business credit exclusively for company expenses, and maintain clear financial records. Lenders scrutinize mixing personal and business transactions as a red flag indicating poor financial management.

Common Funding Mistakes to Avoid

Applying for major credit too soon kills your funding momentum. Entrepreneurs often purchase shelf corporations and immediately apply for large business loans or high-limit credit cards. These premature applications result in denials that damage your business credit score and create negative marks that linger for months.

Neglecting business credit monitoring leaves you blind to errors and fraud. Unlike consumer credit, business credit reports often contain inaccuracies that you must dispute proactively. Register with Dun & Bradstreet, Experian Business, and Equifax Business to track your profile development and catch problems early.

Choosing the wrong corporation type creates tax and operational complications. Some buyers focus solely on age without considering whether they need an LLC, S-corporation, or C-corporation for their specific tax situation. Consult with accountants before purchasing to ensure the entity structure matches your business model.

Building Strong Business Credit Profiles

Establishing your DUNS number creates your business identity in the commercial credit world. Dun & Bradstreet assigns this nine-digit identifier that lenders and vendors use to pull your business credit reports. Register your shelf corporation immediately after purchase and verify all information appears accurately in their database.

Credit utilization ratios impact business credit scores similarly to personal credit. Keep your credit card balances below 30% of available limits, and ideally under 10% for optimal scoring. High utilization signals financial stress even when you make payments on time.

Diversifying your credit mix strengthens your profile over time. Lenders want to see you can manage different credit types responsibly. Combine revolving credit cards with installment loans and vendor trade lines to demonstrate comprehensive credit management skills.

Timeline Expectations for Funding

Month one through three focuses on foundation building. You’ll open bank accounts, establish vendor relationships, and make your first on-time payments. Your business credit reports begin populating with trade line information during this period, though approval odds for substantial credit remain low.

Month four through six represents the qualification phase. Your payment history demonstrates reliability, and your credit file shows sufficient depth for evaluation. You can now apply for business credit cards, small equipment loans, and increased vendor credit limits with reasonable approval odds.

Month seven and beyond opens access to premium financing. With six months of perfect payment history and an established credit profile, you qualify for unsecured business credit cards, term loans, and lines of credit that were previously unavailable. Your shelf corporation with credit now functions as a fully qualified borrowing entity.

Lender Requirements and Qualifications

Time-in-business requirements vary significantly across lenders. Traditional banks typically want two years of operating history, while alternative lenders may accept six months. Your shelf corporation meets the formation date requirement immediately, but you still need to demonstrate actual business operations and revenue.

Personal credit still matters for business financing. Most lenders require personal guarantees for business credit until your company establishes substantial assets and revenue. Expect lenders to check personal credit scores, and understand that scores below 650 may limit your approval options regardless of corporate age.

Revenue documentation becomes necessary for larger credit requests. Lenders want to see bank statements, profit and loss statements, and tax returns proving your ability to repay borrowed funds. Your aged corporation helps you qualify faster, but actual business operations determine your borrowing capacity.

Legal and Compliance Considerations

Corporate Transparency Act reporting applies to most shelf corporations. You must file beneficial ownership information with FinCEN within specific timeframes after acquiring your entity. Failure to comply carries substantial penalties that could jeopardize your business operations and financing applications.

State compliance obligations continue throughout ownership. Maintain your registered agent, file annual reports on time, and pay all franchise taxes when due. Lenders verify corporate good standing before approving credit applications, and compliance lapses can trigger automatic denials.

Accurate information on credit applications is legally required. Never misrepresent your corporation’s operating history, revenue figures, or ownership structure. Credit fraud carries severe penalties including loan acceleration, civil lawsuits, and potential criminal charges.

Advanced Funding Strategies

Layering credit products accelerates your funding capacity. Start with secured business credit cards, add vendor accounts, then stack unsecured cards as you qualify. Each approval increases your total available credit and strengthens your profile for the next application.

Business credit stacking involves opening multiple credit lines within short timeframes. Once you reach the six-month qualification threshold, apply for three to five credit cards within a two-week period. Credit bureaus treat applications within this window as a single inquiry, minimizing score impact.

Wholesaleshelfcorporation provides aged entities specifically structured for optimal funding potential. Their corporations come with complete documentation, verified clean histories, and guidance on activating credit-building strategies. This professional approach eliminates guesswork and accelerates your path to business financing.

Final Thoughts

Shelf corporation funding provides legitimate shortcuts to business credit and financing that typically requires years to achieve. The right aged entity combined with proper activation and credit-building strategies can help you access working capital within months instead of waiting multiple years for organic credit development.

Success depends on treating your shelf corporation as a real business rather than just a credit vehicle. Lenders quickly identify inactive entities that exist solely for credit manipulation. Build genuine operations, maintain perfect compliance, and manage credit responsibly to maximize your funding opportunities.

Wholesale Shelf Corporations delivers premium aged corporations designed for optimal funding potential. Get instant time-in-business credentials that meet lender requirements and accelerate your credit-building timeline. You buy the corp, we get you funded. Contact Wholesale Shelf Corporations today to start accessing the business capital you need to grow.