Introduction

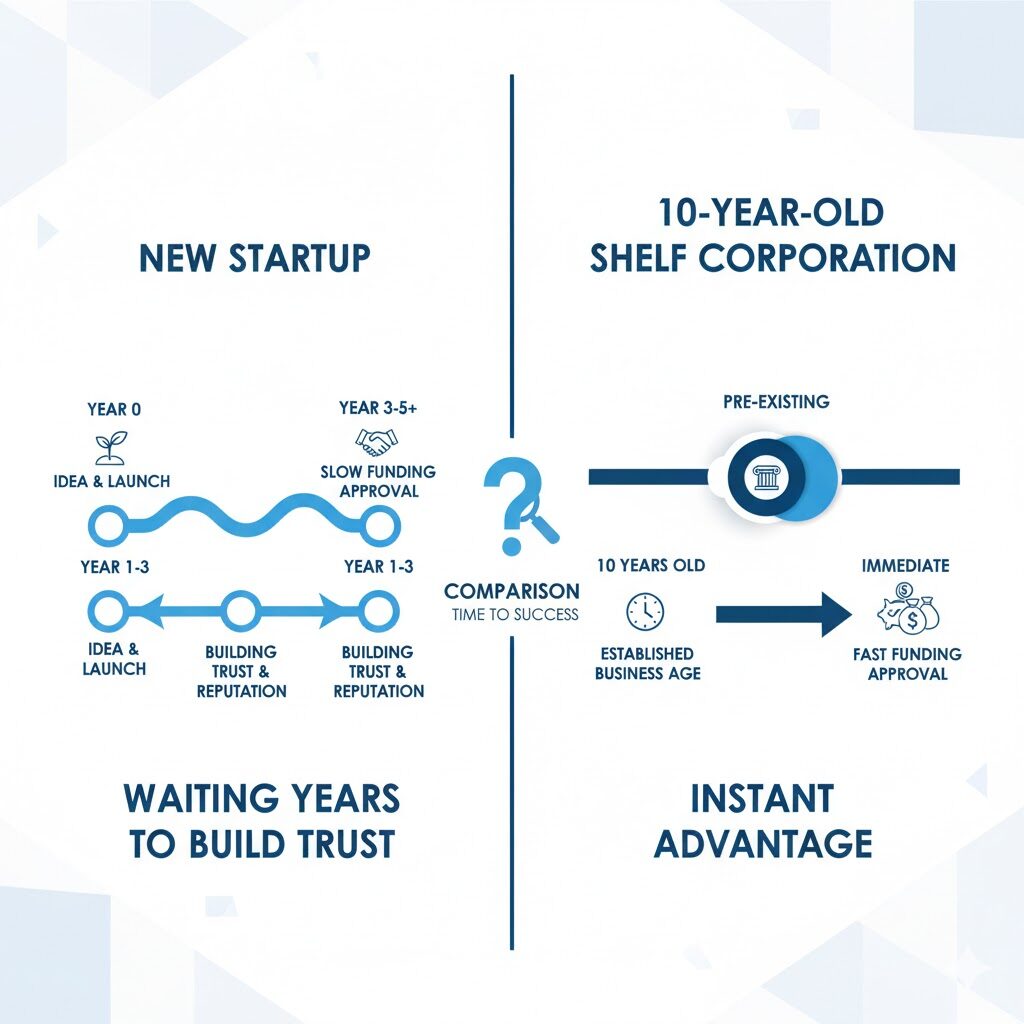

Securing business credit feels impossible when you’re brand new. Lenders see zero history and turn you down. Contractors demand proof of longevity you don’t have yet.

This credibility gap costs entrepreneurs thousands in lost opportunities every month. Banks reject loan applications. Vendors refuse net terms. Government contracts stay out of reach.

Wholesale shelf corporations solve this problem by providing instant business age and credibility. These pre-formed entities come with established filing dates, giving your operation immediate time-in-business without the wait.

This guide reveals everything about the wholesale shelf corporation market. You’ll discover what these entities are, how they work, and why savvy business owners use them to bypass years of waiting. We’ll cover pricing models, legal considerations, and proven strategies for maximizing your investment.

What Is a Wholesale Shelf Corporation?

A wholesale shelf corporation is a pre-registered business entity that was formed years ago but never actively operated. These companies sit “on the shelf” with clean records until purchased.

The defining feature is age. These corporations have established formation dates ranging from two to twenty-plus years old. They possess no assets, liabilities, or operational history just documented existence.

Example: A corporation formed in 2015 with zero activity remains available for purchase in 2025. The buyer acquires a ten-year-old entity instantly, rather than waiting a decade to establish the same credibility.

Wholesale providers maintain inventory of multiple aged entities. They offer bulk pricing and streamlined transfer processes that individual brokers cannot match. This wholesale model reduces costs while maintaining legal compliance.

Why Wholesale Shelf Corporations Matter

Business age unlocks doors that new ventures cannot open. The value extends far beyond simple optics into tangible financial advantages.

Credit Access Amplification

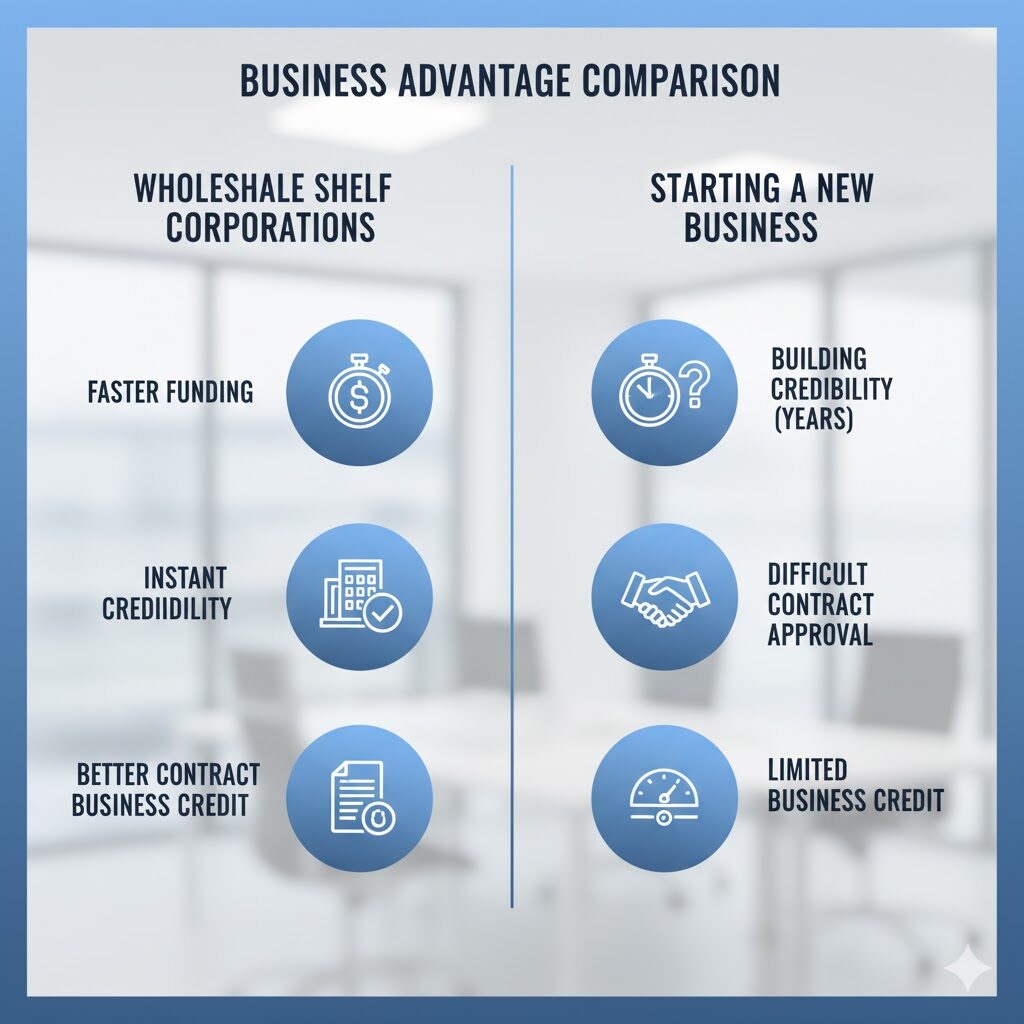

Banks and lenders use time-in-business as a primary approval factor. A two-year minimum often appears in loan requirements. Shelf corporations meet this threshold immediately.

Business credit bureaus like Dun & Bradstreet weight company age heavily in scoring algorithms. Older entities receive better ratings, which translate to higher credit limits and lower interest rates.

Contract Qualification Speed

Government contracts frequently require three to five years of operational history. Shelf corporations satisfy these requirements without the waiting period. This access represents millions in potential contract value.

Private sector contracts also favor established businesses. Vendors conducting due diligence view aged entities as lower-risk partners. This perception accelerates approval processes and improves negotiation leverage.

Cost Efficiency at Scale

Wholesale pricing delivers significant savings compared to retail shelf corporation purchases. Bulk availability means faster acquisition with less administrative friction. The ROI becomes clear when comparing years of organic growth against immediate credibility. Click here to learn more about Why Shelf Corporation Matters.

How the Wholesale Shelf Corporation Process Works

The acquisition process follows a structured pathway designed to ensure legal compliance and smooth ownership transfer.

Step 1: Selection and Verification

Buyers review available inventory filtered by age, state of formation, and entity type. Wholesale providers supply documentation proving clean corporate status. Due diligence confirms no liens, lawsuits, or tax issues exist.

Verification includes checking Secretary of State records. The corporation must show active good standing with all annual reports filed. Any red flags disqualify the entity from sale.

Step 2: Purchase and Transfer

Once selected, the buyer completes a purchase agreement. Payment processes through secure channels with clear terms. The wholesale provider initiates ownership transfer documentation.

This includes stock certificate transfers, updated corporate resolutions, and officer appointments. Legal counsel often reviews documents to ensure proper execution. The entire process typically completes within five to ten business days.

Step 3: Post-Purchase Updates

New owners must update registered agent information with the state. Federal EIN remains unchanged, but responsible party details require updating with the IRS. Business licenses and permits need reapplication under new ownership.

Banking relationships get established using the corporation’s existing age. Credit profiles begin building immediately using the established formation date. The entity becomes fully operational under new management while retaining its historical credibility.

Best Practices & Proven Strategies

Maximizing wholesale shelf corporation value requires strategic implementation beyond simple purchase.

Match Age to Specific Goals

Two-year-old corporations suit basic business credit applications. Five-year entities unlock government contracting opportunities. Ten-plus-year corporations provide maximum credibility for high-value partnerships. Align purchase age with your immediate business objectives.

Maintain Immaculate Compliance

File all required reports immediately after acquisition. Pay annual fees on time without exception. Perfect compliance from day one preserves the credibility you purchased. Any lapse undermines the entire investment.

Build Credit Systematically

Establish vendor accounts reporting to business credit bureaus within thirty days. Use trade lines strategically to demonstrate payment history. The combination of entity age plus recent positive activity creates powerful credit profiles.

Leverage Professional Guidance

Work with attorneys specializing in corporate transitions. CPAs should review tax implications before purchase. This professional input prevents costly mistakes that damage your investment. The consultation fees pale compared to potential problems.

Document Everything Thoroughly

Maintain complete records of the transfer process. Store all corporate documents in organized systems. This documentation proves legitimacy to lenders and partners. Disorganization raises unnecessary red flags during due diligence.

Common Mistakes & Misconceptions

Several dangerous myths circulate about shelf corporations that lead buyers into legal trouble.

Misconception: Shelf Corporations Hide Identity

Some buyers believe shelf corporations provide anonymity. This is false and potentially illegal. All ownership transfers become public record. Using shelf corporations to conceal identity or evade obligations constitutes fraud.

Legitimate uses focus on establishing business age for credibility. Any attempt to mislead creditors or partners crosses legal boundaries. Transparency remains essential throughout the process.

Mistake: Ignoring State-Specific Requirements

Different states impose varying compliance obligations. Delaware corporations follow different rules than Nevada or Wyoming entities. Buyers often purchase without understanding their chosen state’s requirements.

This ignorance leads to administrative dissolution when annual requirements go unfiled. The investment disappears along with the established age. Research state obligations before selecting inventory.

Mistake: Assuming Instant Credit Approval

Entity age helps but doesn’t guarantee credit approval. Lenders evaluate multiple factors including personal credit, business plan, and financial statements. The shelf corporation provides one advantage among many required elements.

Unrealistic expectations lead to disappointment. View shelf corporations as credibility boosters, not magic solutions. Combine them with solid business fundamentals for best results.

Mistake: Purchasing from Unverified Sources

Disreputable sellers offer shelf corporations with hidden problems. Undisclosed liens, tax issues, or fraudulent history can transfer to buyers. These problems cost thousands to resolve and damage business prospects.

Only work with established wholesale providers offering complete documentation. Verify their reputation through independent reviews and professional references. The few hundred dollars saved buying from sketchy sources costs far more when problems emerge.

Helpful Tools & Resources

Several platforms and services support successful shelf corporation acquisition and management.

Wholesale Shelf Corporations provides industry-leading inventory with comprehensive vetting processes. Their “You Buy The Corp. We Get You Funded” approach combines entity sales with funding expertise. This integrated service maximizes the value of your purchase.

Secretary of State Databases offer free verification of corporate status. Check these official sources before finalizing any purchase. Confirm filing dates, good standing status, and registered agent information match seller claims.

Business Credit Monitoring Services like Nav, Dun & Bradstreet, and Experian Business track your corporate credit development. These tools help you leverage your entity’s age into tangible credit improvements. Regular monitoring catches issues before they become serious problems.

Corporate Compliance Software such as Harbor Compliance and Corporation Service Company automate filing requirements. These platforms prevent the administrative oversights that undermine shelf corporation investments. Automated reminders ensure deadlines never slip past.

Legal Zoom and Rocket Lawyer provide affordable access to basic legal documents and guidance. While not replacements for specialized attorneys, these platforms offer templates for corporate resolutions and standard documentation needs.

Future Trends & Advanced Insights

The wholesale shelf corporation market continues evolving as regulations and business practices shift.

Increased Regulatory Scrutiny

Government agencies increasingly monitor shelf corporation transactions for fraud prevention. The Corporate Transparency Act requires beneficial ownership reporting for most entities. Compliance requirements will intensify, making reputable providers more valuable.

Legitimate wholesale operations already implement enhanced verification processes. This trend separates professional providers from questionable sellers. Expect stricter documentation requirements and more thorough buyer vetting.

Blockchain-Based Verification

Some jurisdictions explore blockchain technology for corporate record-keeping. Wyoming leads this innovation with digital asset-friendly legislation. Future shelf corporation transfers might occur through smart contracts with automated verification.

This technology could streamline the acquisition process while increasing transparency. Immutable blockchain records would prevent fraudulent history claims. Early adopters gain competitive advantages as these systems develop.

Integration with Alternative Funding

Wholesale providers increasingly partner with alternative lenders and credit platforms. This integration creates complete solutions combining entity age with immediate funding access. The “instant credibility plus instant capital” model addresses entrepreneurs’ most pressing needs simultaneously.

Revenue-based financing and merchant cash advance providers recognize shelf corporation value. These partnerships expand beyond traditional bank lending into more flexible funding structures.

Unlock Business Credibility Today

Wholesale shelf corporations deliver immediate business age that would otherwise require years to establish. This credibility opens doors to funding, contracts, and vendor relationships unavailable to new entities.

The strategic advantage is clear. While competitors wait years to build track records, you start with established credibility from day one. This head start translates directly to revenue opportunities and growth acceleration.

Smart implementation requires choosing reputable providers, maintaining perfect compliance, and combining entity age with solid business fundamentals. The investment pays dividends when approached strategically.

Contact Wholesale Shelf Corporations today for instant time-in-business solutions. Their expert team guides you through selection, purchase, and post-acquisition success. You buy the corporation they help you get funded.

Get started now and transform your business credibility overnight. The opportunity cost of waiting measured in lost contracts and rejected applications far exceeds the investment in established business age.