Introduction

Purchasing an aged business entity seems straightforward until tax season arrives and confusion sets in. The IRS processed over 33 million business tax returns in 2024, and many entrepreneurs who acquired shelf corporations made preventable mistakes that triggered audits or penalty assessments. Understanding the tax treatment of your purchased entity before you start operations saves thousands in professional fees and potential IRS penalties.

Shelf corporation taxes operate differently than most business owners expect because you acquire an existing legal entity rather than forming a new one. The timing of ownership transfer, your choice of tax classification, and how you handle the transition period all create specific obligations. Many buyers incorrectly assume they can simply continue using the corporation’s existing tax identification number and prior filing history.

Wholesale Shelf Corporations helps entrepreneurs navigate these tax complexities with clear guidance on proper procedures and compliance requirements. The federal and state tax treatment of your acquired corporation depends on several factors including when you take ownership, whether you obtain a new EIN, and how you structure the purchase transaction itself.

This guide clarifies exactly how shelf corporation taxes work from the moment you acquire the entity through your first tax filing season. You will learn which IRS forms you must file, how to properly establish your tax basis, and strategies for maximizing deductions while staying compliant. We also cover common tax mistakes that buyers make and provide actionable steps to protect yourself from unnecessary liability or penalties.

What Are Shelf Corporation Taxes

Shelf corporation taxes refer to the federal and state tax obligations that arise when you purchase and begin operating a previously dormant aged entity. These tax responsibilities differ from starting a brand-new business because the corporation already exists as a legal taxpayer with an established filing history. The IRS and state revenue agencies must be properly notified about the ownership change to ensure accurate tax treatment.

When you acquire a shelf corporation, you assume responsibility for filing all required returns starting from your ownership effective date. The previous owners handled tax compliance during the dormant period, typically filing zero-activity returns that showed the corporation existed but conducted no business. Your obligation begins the moment you take control and especially when you start generating revenue or incurring deductible expenses.

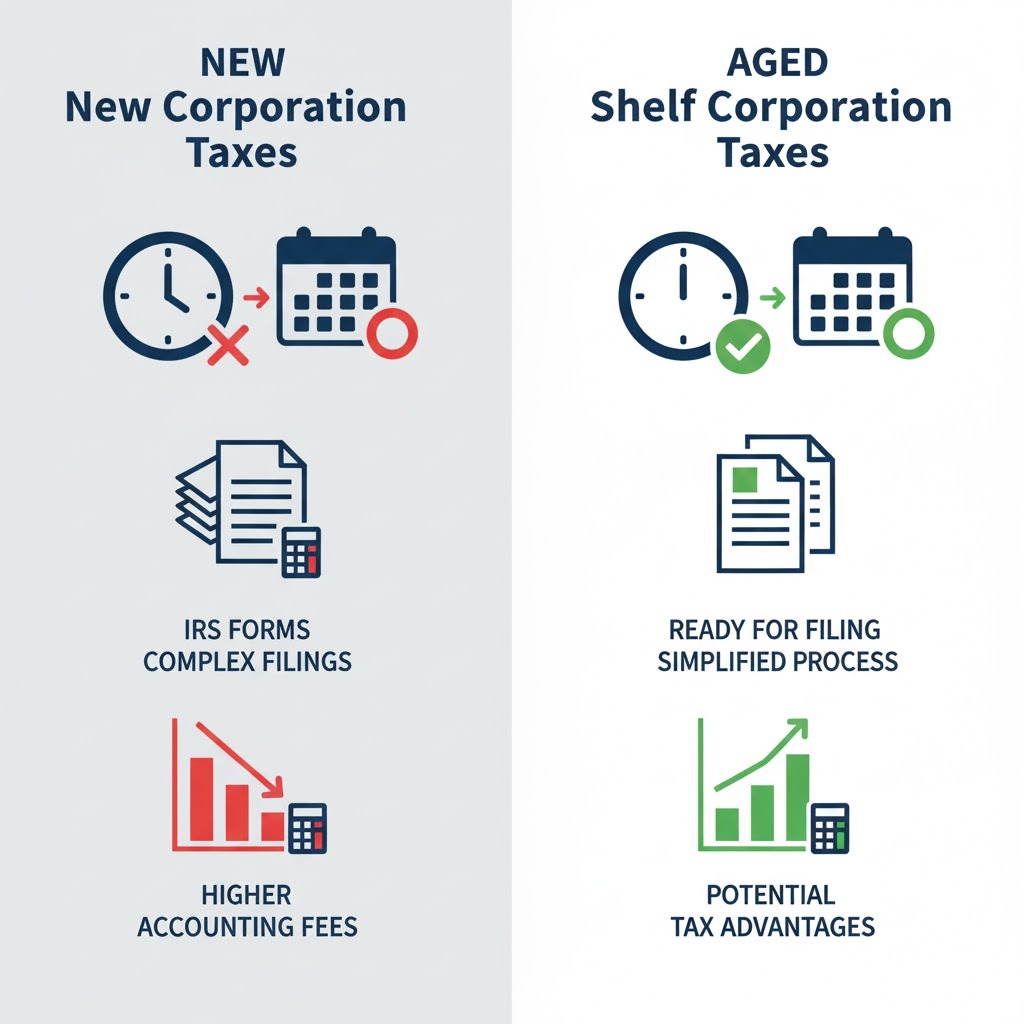

The tax classification of your shelf corporation matters tremendously for your filing requirements and overall tax burden. Most aged corporations are formed as C-corporations by default, but you can elect S-corporation status or even disregarded entity treatment depending on your ownership structure. Each classification creates different obligations for quarterly estimated payments, annual filings, and potential state-level franchise taxes regardless of activity level.

Why Shelf Corporation Tax Planning Matters

Proper tax planning for your acquired entity prevents costly mistakes that could eliminate any time-in-business advantages you purchased. The IRS takes a dim view of businesses that fail to properly report ownership changes or attempt to obscure corporate history through improper continuation of old EIN numbers. Audits triggered by these red flags waste valuable time and money defending your legitimate acquisition.

Understanding tax benefits of shelf corporation structures allows you to maximize deductions and minimize your effective tax rate from day one. Aged corporations qualify for identical deductions as newly formed entities, but timing your first operational year strategically can increase your available write-offs. Startup costs, organizational expenses, and Section 179 depreciation all become available tools when you understand how to properly claim them.

State tax obligations vary dramatically depending on where your shelf corporation was originally formed versus where you actually conduct business. Some states impose franchise taxes or minimum fees on all corporations regardless of activity levels. Failing to account for these obligations in your budget creates unwelcome surprises and potential compliance gaps that damage your business credit profile.

Planning your tax structure before activating the corporation also protects you from double taxation scenarios that plague uninformed C-corporation owners. Many entrepreneurs discover too late that their shelf corporation’s default tax status creates both corporate-level and personal tax obligations on the same income. Early elections for S-corporation or LLC treatment prevent this inefficiency if you act within required IRS deadlines.

How Shelf Corporation Tax Treatment Works

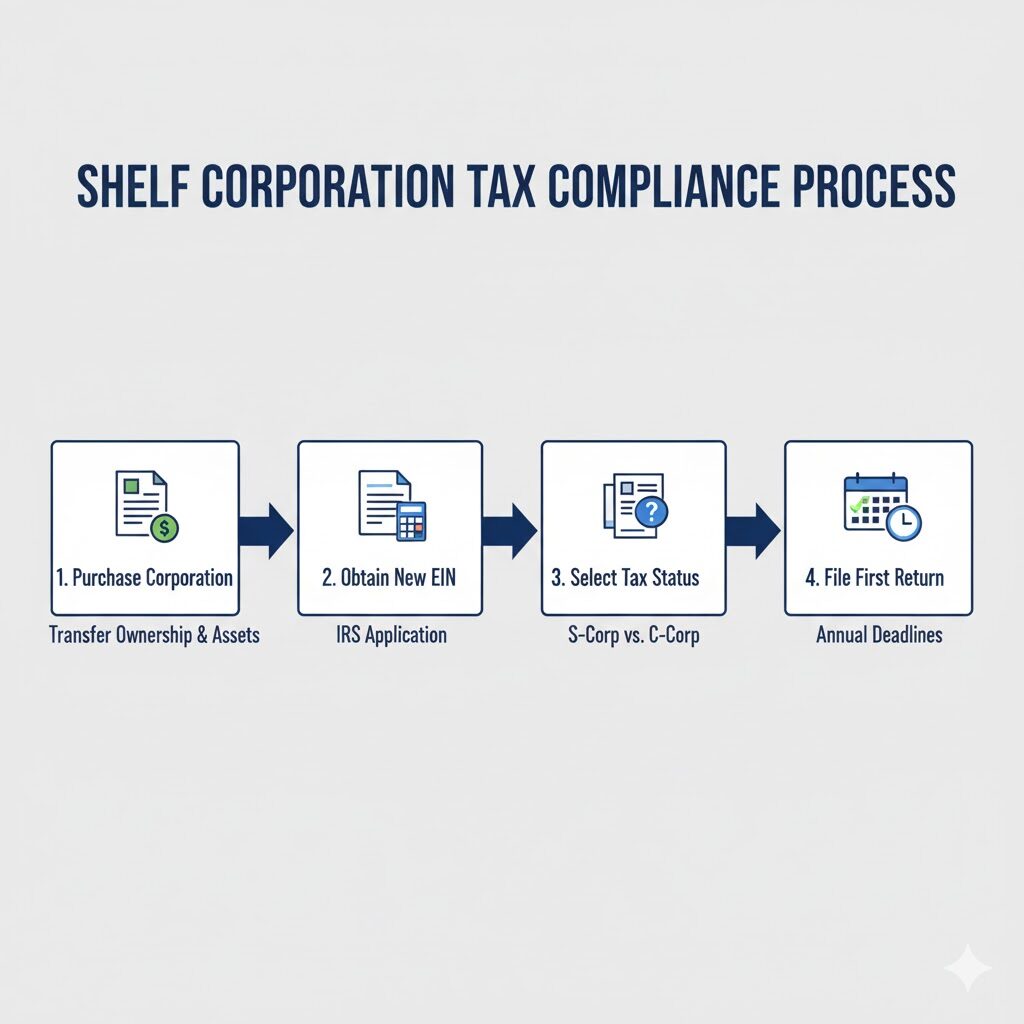

The tax treatment of your shelf corporation begins with obtaining a new Employer Identification Number from the IRS immediately after completing the ownership transfer. This critical step establishes a clear tax boundary between the dormant period under previous ownership and your active operations. You file Form SS-4 online or by mail, identifying yourself as the new responsible party for the corporation.

Once you have your new EIN, you determine which tax classification best serves your business goals and file any necessary election forms. If you want S-corporation status instead of the default C-corporation treatment, you must file Form 2553 within two months and fifteen days after the beginning of the tax year when you want the election to take effect. Missing this deadline forces you to operate as a C-corporation for the entire year.

Your acquired corporation must file federal income tax returns based on its calendar or fiscal year, starting with the year in which you begin operations. If the previous owners filed returns on a calendar year basis and you take ownership in July, you need to file a short-year return covering January through June showing zero activity, then begin your operational returns. Most buyers simplify this by timing acquisitions near year-end to create clean breaks.

State tax obligations activate based on where your corporation is domiciled and where it conducts business operations. You must register as a foreign corporation in any state where you have physical presence, employees, or substantial economic activity beyond your incorporation state. Each jurisdiction then requires separate income tax returns, franchise tax filings, or both depending on local regulations.

Quarterly estimated tax payments become mandatory once your corporation generates net income above certain thresholds. C-corporations must make estimated payments if they expect to owe $500 or more in tax for the year. S-corporations generally do not make entity-level estimated payments, but shareholders must cover their pass-through income through personal estimated payments or increased withholding from other sources.

Best Practices for Managing Shelf Corporation Taxes

Engage a qualified tax professional who specializes in business acquisitions before you finalize your shelf corporation purchase. CPAs and enrolled agents familiar with corporate tax law identify potential issues specific to your situation and structure the transaction properly. This upfront investment prevents expensive corrections later and ensures you claim all available deductions from the start.

Open a dedicated business bank account using your new EIN immediately after the ownership transfer completes. Never commingle personal funds with corporate accounts or continue using any accounts that existed under previous ownership. This financial separation proves essential for maintaining corporate liability protection and creates clean records for tax reporting purposes.

Establish an accounting system that tracks income and expenses from your very first business transaction. Software like QuickBooks Online, Xero, or FreshBooks integrates with your bank accounts and generates reports that simplify tax preparation. Many business owners wait until tax season to organize records, creating unnecessary stress and potential missed deductions.

File all required tax elections within IRS deadlines to secure your desired tax treatment. S-corporation elections, fiscal year elections, and accounting method choices must be timely or you lose the option for that tax year. Calendar reminders and working with your tax professional ensure you never miss critical filing windows.

Maintain complete corporate records including board meeting minutes that document major tax decisions. When you elect S-corporation status, change accounting methods, or make other significant tax choices, memorialize these decisions in corporate minutes. This documentation proves you followed proper procedures if the IRS ever questions your tax treatment.

Common Tax Mistakes With Shelf Corporations

Many buyers wrongly believe they can continue using the shelf corporation’s original EIN from the dormant period. This mistake creates serious problems because it attributes your business activities to the previous ownership period and fails to properly notify the IRS about the ownership change. Always obtain a new EIN to establish a clear tax identity under your control.

Some entrepreneurs neglect to file state tax registrations in jurisdictions where they conduct business beyond their incorporation state. Operating without proper state registrations leads to back-tax assessments, penalties, and potential loss of limited liability protection. Research nexus rules for every state where you have customers, employees, or physical operations.

Failing to make timely S-corporation elections traps many shelf corporation buyers in unwanted C-corporation status for an entire year. The IRS grants limited relief for late elections only in specific circumstances with reasonable cause. Planning your acquisition date around election deadlines prevents this costly error that can thousands in additional taxes.

Mixing personal and business expenses during the startup phase undermines your corporate liability shield and creates tax reporting nightmares. Every dollar that flows through your corporation must be properly characterized as either business income or expense, capital contribution, or distribution. Sloppy bookkeeping invites audits and jeopardizes the entire reason you purchased an aged entity.

Ignoring state franchise taxes or minimum fees because your corporation shows little or no income represents another common mistake. Many states assess fees based simply on the corporation’s existence regardless of profitability. Missing these payments leads to penalties, interest, and potential administrative dissolution that destroys your valuable business aging.

Essential Tax Tools and Resources

Professional tax preparation software designed for corporations helps you accurately complete returns and identify available deductions. Programs like TurboTax Business, TaxAct Business, or H&R Block Premium & Business handle corporate returns including C-corporations and S-corporations. These platforms walk you through schedules and forms while checking for common errors.

IRS publications provide authoritative guidance on corporate tax obligations and can be accessed free from the IRS website. Publication 542 covers corporations, Publication 334 addresses small business taxes, and Publication 583 explains record-keeping requirements. Reading these documents helps you understand your obligations and avoid reliance on internet myths.

State revenue department websites offer jurisdiction-specific guidance on franchise taxes, income taxes, and registration requirements. Bookmark your state’s business tax portal and subscribe to email updates about law changes or filing deadline reminders. Most states also provide online payment options and compliance tracking tools.

Business accounting software with tax preparation features streamlines your record-keeping throughout the year. QuickBooks Self-Employed, Wave Accounting, or Zoho Books all generate profit and loss statements, balance sheets, and transaction reports your tax preparer needs. Cloud-based systems also provide secure access for your CPA without exchanging paper documents.

Professional networks and industry associations often provide tax planning resources specific to your business sector. Organizations like SCORE offer free mentoring from retired executives who understand corporate taxation. Local small business development centers also host tax workshops and connect you with qualified preparers who work with shelf corporations regularly.

Advanced Tax Strategies for Shelf Corporations

Consider timing your shelf corporation purchase to align with your planned business launch and optimize your first tax year. Acquiring the entity in the fourth quarter gives you time to establish accounts and systems before your busy season. Starting operations in January with a full year ahead simplifies accounting and prevents short-year return complications.

Maximize Section 179 expensing and bonus depreciation for equipment purchases you make shortly after acquiring the shelf corporation. The IRS allows immediate deduction of qualifying business assets up to $1,220,000 for 2025 rather than depreciating them over several years. This powerful tool reduces your taxable income substantially in your first operational year.

Structure compensation to yourself and any employees tax-efficiently based on your corporation’s tax classification. S-corporation owners must pay themselves reasonable salaries subject to payroll taxes, but can take additional profits as distributions that avoid FICA taxes. C-corporation owners balance salary deductions against double taxation on profits distributed as dividends.

Establish retirement plans like SEP-IRAs, SIMPLE IRAs, or 401(k)s immediately after starting operations to reduce taxable income while building wealth. Shelf corporations qualify for identical retirement plan options as any established business. Contributions are deductible business expenses that lower your tax bill while funding your future.

Analyze whether your shelf corporation should elect fiscal year rather than calendar year reporting. Certain seasonal businesses benefit from fiscal years that align their busiest periods with year-end inventory and income recognition strategies. This election must be made early and maintained consistently to avoid IRS scrutiny.

State-Specific Tax Considerations

Different states treat shelf corporations uniquely for franchise tax and income tax purposes based on incorporation location versus operational location. Delaware corporations pay franchise taxes to Delaware regardless of where they actually operate, plus income taxes in their business location state. Understanding this dual obligation prevents surprises and allows accurate tax budgeting.

States like California, New York, and Illinois impose substantial minimum franchise taxes or fees that apply even when your corporation shows no profit. California’s $800 annual minimum tax applies to virtually all corporations doing business in the state. Factor these costs into your shelf corporation selection and budget accordingly.

Sales tax obligations arise based on where your customers are located rather than where your corporation formed. If you sell taxable goods or services to customers in multiple states, you may need to register for sales tax collection in each jurisdiction. Recent Supreme Court decisions expanded state authority to require out-of-state sellers to collect local sales taxes.

Some states offer tax incentives or reduced rates for corporations in specific industries or locations. Research whether your planned business activities qualify for enterprise zone benefits, industry-specific credits, or new business incentives. These opportunities sometimes provide substantial savings during your early operational years.

Annual report filing deadlines and associated fees vary by state and missing them can result in administrative dissolution. Your shelf corporation likely has an established filing date you must maintain to preserve good standing. Calendar these deadlines immediately and budget for filing fees that range from minimal amounts to several hundred dollars depending on your state.

Final Words

Understanding shelf corporation taxes protects your investment in aged business entities and positions you for compliant growth from day one. The key principles involve obtaining a new EIN, electing appropriate tax classification within IRS deadlines, and maintaining immaculate separation between personal and business finances. Proper planning transforms potential tax obstacles into manageable compliance tasks that support your business goals.

Working with qualified tax professionals who understand shelf corporation acquisitions proves invaluable for navigating federal and state requirements. These specialists identify deduction opportunities you might miss, ensure timely filing of all elections, and provide ongoing support as your business scales. The cost of professional guidance represents a fraction of potential penalties or missed tax savings.

Wholesale Shelf Corporations provides comprehensive support for tax planning alongside our aged entity offerings. Our team connects you with experienced tax advisors who specialize in shelf corporation acquisitions and understand the unique compliance requirements. We ensure you receive complete documentation needed for tax reporting and help you establish proper accounting systems from the start.

Your acquired corporation’s tax structure directly impacts profitability, cash flow, and long-term financial health. Taking time to understand these obligations and implement best practices pays returns throughout your ownership. The tax benefits of shelf corporation structures become accessible when you follow proper procedures and maintain diligent records.

Contact Wholesale Shelf Corporations today to explore aged entities that match your business needs and receive expert guidance on tax planning. Get Instant Time-In-Business while establishing a solid tax foundation that supports sustainable growth. You Buy The Corp, We Get You Funded with the knowledge and support necessary for complete tax compliance and strategic advantage.