Introduction

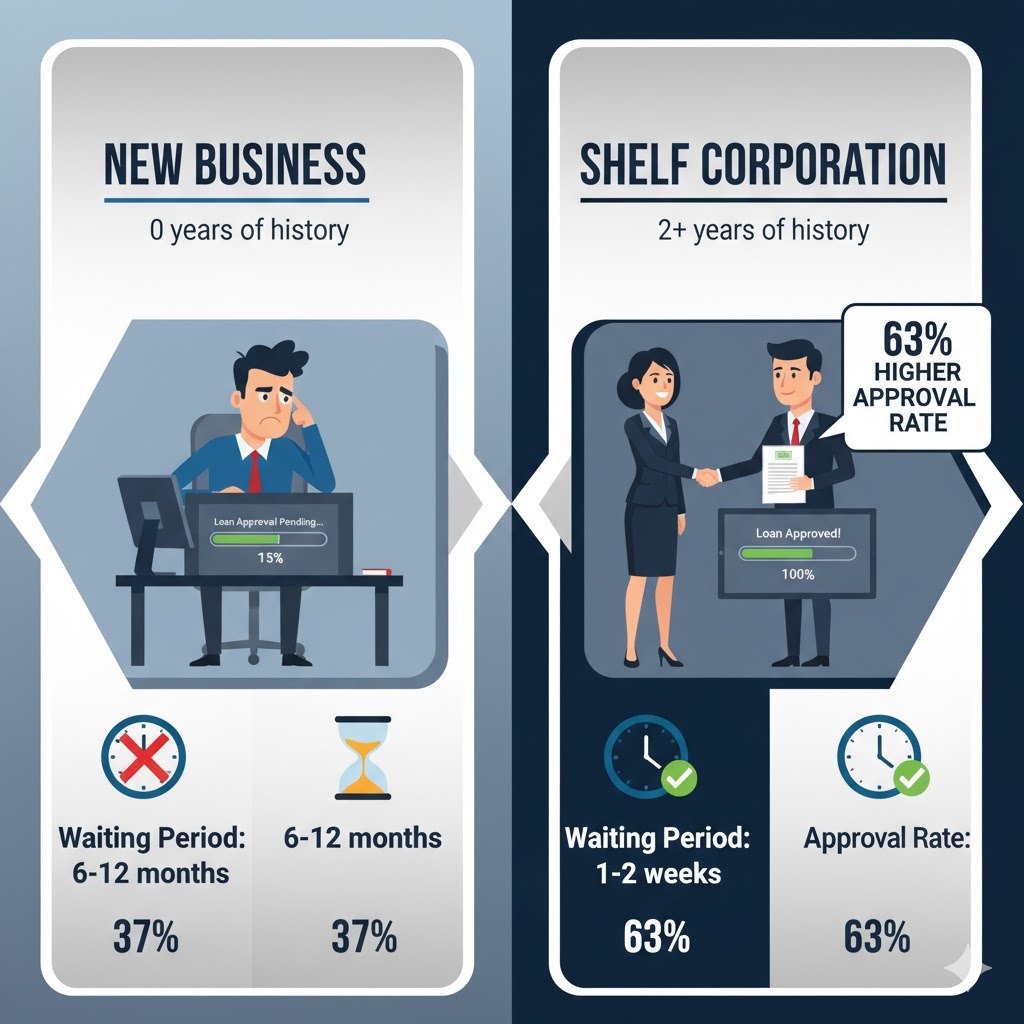

Starting a business from scratch takes years to build credibility with vendors, lenders, and clients. Most entrepreneurs face immediate roadblocks when trying to secure financing or establish trade lines because their company lacks operational history. Recent data shows that businesses with two or more years of history receive loan approvals at rates 63% higher than brand-new entities.

The transfer shelf corporation process offers a proven solution to this challenge. When you acquire an aged corporation that has been legally maintained but never actively operated, you instantly gain the time-in-business advantage that financial institutions and suppliers value. This ownership change process allows you to skip years of waiting and start building business credit immediately.

Wholesale Shelf Corporations specializes in helping entrepreneurs navigate this acquisition strategy with complete legal compliance and seamless transitions. Understanding how to properly transfer ownership ensures you maintain the corporation’s valuable aging while protecting yourself from potential liabilities. This guide walks you through every step of the ownership change process, from initial selection through final documentation.

You will learn what makes a shelf corporation valuable, how the transfer process actually works, and which best practices ensure a smooth transition. We cover common mistakes that can invalidate your purchase and provide actionable strategies for maximizing your new corporation’s benefits. Whether you need immediate vendor accounts or plan to apply for business financing, this comprehensive resource equips you with the knowledge to make informed decisions about acquiring an aged entity.

What Is a Shelf Corporation Transfer

A shelf corporation transfer is the legal process of changing ownership from the original incorporators to a new buyer who wants established business history. These dormant companies were created years ago, properly maintained with compliance filings, but never conducted actual business operations. The transfer involves updating corporate records, issuing new stock certificates, and filing necessary paperwork with state authorities.

The term “shelf corporation” comes from the practice of letting these entities sit on a metaphorical shelf while they age like fine wine. Unlike buying an active business with existing operations and potential liabilities, you acquire only the corporate structure and its aging. This distinction matters because lenders and creditors primarily evaluate how long a business has existed when making approval decisions.

During the ownership change process, the previous owners resign from all officer and director positions. You become the sole shareholder and assume complete control of the corporation. State agencies receive updated information showing the new ownership structure, ensuring all public records reflect your authority over the entity.

Why Transfer a Shelf Corporation Matters

Acquiring an aged corporation through proper transfer procedures accelerates your ability to access business financing that would otherwise take years to qualify for. Banks and alternative lenders often require a minimum of two years in business before approving significant credit lines or loans. By transferring ownership of a properly aged shelf corporation, you immediately meet this fundamental requirement without waiting.

The ownership change process also opens doors to better vendor relationships and payment terms. Suppliers frequently check business credit reports before extending net-30 or net-60 payment arrangements. A corporation with several years of history appears more stable and trustworthy than a newly formed entity, even if both have similar financial statements.

Beyond lending and credit opportunities, an established corporation provides instant credibility with potential clients and partners. Professional service providers, contractors, and consultants particularly benefit from this perceived stability. When prospects research your company and see it has been operating since 2020 or earlier, they feel more confident entering into agreements compared to dealing with a brand-new startup. Why Shelf Business Matters?

How the Ownership Change Process Works

The transfer shelf corporation process begins with selecting an entity that matches your business needs and timeline requirements. Reputable providers maintain inventories of corporations formed in various states with different incorporation dates. You choose based on factors like desired age, state of incorporation, tax classification, and industry naming conventions that align with your business plan.

Once you select your shelf corporation, the seller initiates the formal transfer documentation. This includes preparing stock transfer ledgers that legally convey ownership of all issued shares to you as the new owner. The corporation’s registered agent receives updated contact information, and all officer and director positions transfer to individuals you designate, typically yourself or trusted partners.

State filing requirements vary depending on where the corporation was originally formed. Most states require filing amended articles or certificates showing the new officers, directors, and registered office address. Some jurisdictions also mandate updated annual reports even if one was recently filed. Your provider should handle these filings or clearly explain which documents you must submit to maintain compliance.

After completing state-level transfers, you obtain a new Employer Identification Number from the IRS by filing Form SS-4. Even though the corporation previously had an EIN, getting a fresh number protects you from any tax liabilities associated with the previous ownership period. This step is absolutely critical and should never be skipped regardless of what anyone suggests.

The final phase involves opening new bank accounts and establishing your corporate records book with updated bylaws, stock certificates, and meeting minutes. These documents create a clear paper trail showing when ownership changed hands. Maintaining this documentation protects you legally and proves to creditors that you legitimately acquired the corporation through proper channels.

Best Practices for Smooth Ownership Transfers

Always purchase your shelf corporation from established providers who specialize in this service and maintain proper compliance for all their inventory. Wholesale Shelf Corporations ensures every entity remains in good standing with annual filings completed and registered agents active. Working with reputable sellers protects you from inheriting compliance issues that could invalidate the corporation’s aging or create legal problems.

Conduct thorough due diligence before finalizing any transfer by requesting complete corporate records and verification of clean history. Review all filed documents with your state’s secretary of state office to confirm the corporation has no judgments, liens, or pending litigation. Request bank verification letters proving the entity never opened accounts or conducted transactions that could create hidden liabilities.

Obtain comprehensive representations and warranties from the seller guaranteeing the corporation’s clean status. These written assurances should specifically state that the entity never operated a business, has no debts or obligations, and remains in good standing with all regulatory authorities. Quality providers offer these guarantees as standard practice because they know their inventory is properly maintained.

Work with experienced business attorneys or formation specialists who understand shelf corporation transfers and can review all documentation. Legal professionals identify potential issues before they become problems and ensure your paperwork meets all state-specific requirements. This investment pays for itself by preventing costly mistakes that could undermine the entire purpose of acquiring an aged entity. Click here to learn about Shelf Corporation Legal Requirements: Your 2025 Guide

Execute the transfer during a calendar year-end period when possible to simplify your accounting and tax reporting. Taking ownership in late December or early January creates a clean break between the dormant period and your active operations. This timing makes it easier to explain the ownership change to creditors and provides clear delineation for financial statements.

Common Mistakes During Corporation Transfers

Many buyers make the critical error of continuing to use the previous Employer Identification Number instead of obtaining a new one from the IRS. This mistake creates serious tax complications and potentially subjects you to liabilities from the dormant period. Always file for a fresh EIN immediately after completing the ownership transfer to establish a clear separation between old and new ownership.

Some purchasers fail to properly update state records with new officer and director information, leaving the previous owners technically in control. This oversight can invalidate your ownership claim and create confusion when you try to open bank accounts or apply for business credit. File all required amendments promptly and keep confirmation receipts proving the state accepted your updated information.

Neglecting to obtain adequate documentation proving the corporation’s clean history represents another frequent mistake. Buyers sometimes accept verbal assurances without requesting written verification of good standing, absence of debts, and compliance history. Always insist on comprehensive documentation and independently verify key facts with state authorities before completing the purchase.

Rushing the transfer process without proper legal review often leads to incomplete paperwork or missed filing requirements. Each state has specific procedures for ownership changes, and skipping steps can jeopardize the corporation’s standing. Take time to ensure every document is correctly prepared and filed rather than trying to rush through the process.

Starting to use the corporation for business operations before completing all transfer steps creates unnecessary legal risks. Wait until you have filed all required documents, obtained your new EIN, and opened bank accounts in the corporation’s name. This patience ensures clean separation between the dormant period and your active operations, protecting both the corporation’s aging value and your personal liability protection.

Essential Tools and Resources for Transfers

Corporate record-keeping software helps you maintain organized documentation of your ownership transfer and ongoing corporate compliance. Programs like CorpNet, Harbor Compliance, or simple solutions like Evernote let you store articles of incorporation, bylaws, stock certificates, and meeting minutes in one secure location. Proper organization proves invaluable when creditors or lenders request corporate documentation.

State secretary of state websites provide free access to verify corporation status, view filed documents, and submit required amendments. Bookmark your state’s business entity database and check it regularly to ensure your corporation maintains good standing. These portals also show you exactly which forms are required for ownership transfers in your specific jurisdiction.

Business credit monitoring services from Dun & Bradstreet, Experian Business, and Equifax Business allow you to track how your acquired corporation appears in commercial credit databases. Setting up monitoring immediately after the transfer lets you spot any incorrect information and begin building a positive payment history. Many business credit card issuers and vendors report to these bureaus, making monitoring essential for your credit-building strategy.

Registered agent services ensure your corporation receives all official correspondence and maintains compliance with state requirements. Quality registered agents like Northwest Registered Agent or Incfile provide reliable mail forwarding and alert you to important filing deadlines. Since the transfer changes the registered agent information, selecting a dependable service provider protects your corporation’s good standing.

Legal document automation platforms such as LegalZoom, Rocket Lawyer, or state-specific services streamline the preparation of transfer documents and ongoing corporate maintenance. These tools provide templates for stock transfer agreements, board resolutions, and meeting minutes that comply with your state’s requirements. While not replacing attorney review for complex situations, they offer cost-effective solutions for standard documentation needs.

Advanced Strategies for Maximizing Transfer Benefits

Consider acquiring multiple shelf corporations in different states to create a network of entities for various business purposes. Some entrepreneurs use one aged corporation for credit building while operating their main business through another entity. This strategy separates your credit-building activities from operational risks and provides flexibility as your business grows across state lines.

Time your shelf corporation purchase to align with specific lending or vendor application deadlines. If you know you will need business financing in three months, acquiring the aged entity now gives you time to establish banking relationships and prepare documentation. This proactive approach maximizes your chances of approval when you submit formal applications.

Leverage your acquired corporation’s aging to apply for business credit cards with high limits before establishing significant operational history. Card issuers evaluate time-in-business heavily, and your shelf corporation immediately qualifies you for products that would otherwise require years of waiting. Use these accounts responsibly to build payment history that strengthens your business credit profile.

Structure your ownership transfer to position the corporation for specific industry opportunities that value established entities. Some government contracts, franchise opportunities, or vendor programs require minimum years in business. Your aged corporation opens doors to these opportunities that would remain closed to newly formed companies.

Combine your shelf corporation acquisition with proper business credit building strategies to accelerate your financial growth. Apply for starter vendor accounts that report to business bureaus, maintain perfect payment records, and gradually work up to larger credit lines. The combination of instant aging plus active credit building creates powerful momentum toward your financing goals.

Final Words

The transfer shelf corporation ownership process provides entrepreneurs with immediate business history that would otherwise take years to establish. By understanding how to properly acquire and transition an aged entity, you position yourself for faster access to business credit, better vendor terms, and increased credibility with clients. The key lies in working with reputable providers, following proper legal procedures, and avoiding common mistakes that undermine your investment.

Success with shelf corporations requires thorough due diligence, complete documentation, and patience to execute every transfer step correctly. When done right, this strategy delivers genuine advantages that accelerate your business growth and open doors to opportunities unavailable to brand-new companies. The time and effort invested in proper ownership transfer pays dividends through enhanced lending options and stronger vendor relationships.

Wholesale Shelf Corporations stands ready to guide you through every aspect of acquiring and transferring an aged entity that matches your specific business needs. Our inventory includes corporations of various ages, formed in business-friendly states, and maintained in perfect compliance. We provide comprehensive documentation, handle state filings, and offer ongoing support to ensure your transfer succeeds.

Contact Wholesale Shelf Corporations today to explore available aged entities and Get Instant Time-In-Business that positions your venture for immediate growth. Our team answers your questions, explains exactly how each corporation was maintained, and walks you through the complete ownership change process. You Buy The Corp, We Get You Funded with the credibility and history that lenders demand.